Project Summary & Key Insights

Executive Summary

This study analyzes three credit card acquisition strategies, revealing optimal approaches for different consumer profiles. Through a Miro flowchart detailing strategic card sequences and an interactive Tableau dashboard modeling financial outcomes, we've quantified how consumers can generate significant value ($41-$173/month) through systematic card acquisition. Our findings show No Fee Flamingo offers best ROI (53%), Business Bee delivers highest returns ($3,121 over 18 months), and Chase dominates across all segments. Banks maintain profitability through merchant fees, annual fees, and interest from non-strategic customers.

Optimal Consumer Strategy

Choose a strategy matching your spending capacity and financial goals

Cancel or downgrade cards strategically to avoid unnecessary annual fees

Optimize category spending to maximize rewards value

Consider long-term sustainability rather than short-term gains

Cancel or downgrade cards strategically to avoid unnecessary annual fees

Optimize category spending to maximize rewards value

Consider long-term sustainability rather than short-term gains

Optimal Lender Strategy

Position strategically across customer segments to drive acquisition

Create product ecosystems for cross-selling opportunities

Balance generous rewards with profit mechanisms

Target appropriate consumer personas to optimize portfolio performance

Create product ecosystems for cross-selling opportunities

Balance generous rewards with profit mechanisms

Target appropriate consumer personas to optimize portfolio performance

Conclusion

Credit card churning allows consumers to extract significant value from financial institutions. Strategic consumers can generate hundreds or thousands of dollars through systematic card acquisition, but banks maintain profitability through built-in mechanisms. The optimal consumer strategy aligns with your spending habits, risk tolerance, and organizational capacity. Is this "gaming the system"? Perhaps - but banks continue offering these incentives because they work as customer acquisition tools within their broader business model.

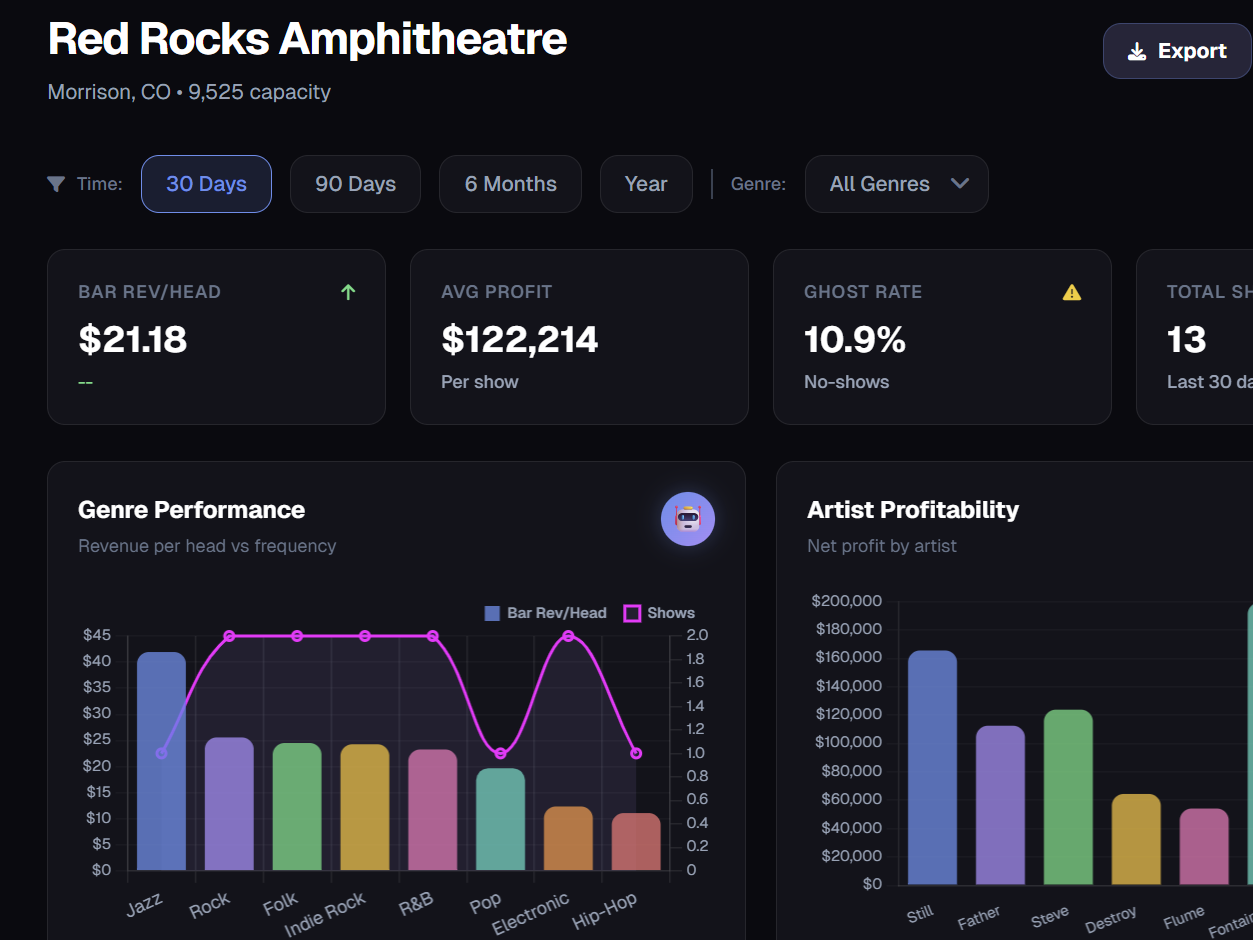

Tableau Dashboard

Consumer Persona Breakdown

Lender Positioning Breakdown

🦩 No Fee Flamingo

Strategy: No annual fees, cash back focus

Cards: Secured/Student Card → 5% Rotating Card → 2% Flat Card → Custom 5% Card

Best for: Beginners, low spenders, credit builders

Key metrics: $41/month average value, 16% value per dollar spent

🏦 JP Morgan Chase

Strategy: Full-spectrum domination, diverse ecosystem, premium benefits

Target Personas: All three (No Fee Flamingo, Traveling Toucan, Business Bee)

Key Cards: Chase Freedom Flex, Chase Sapphire Preferred, Chase Ink Business lineup

Market Position: Dominant across all segments, particularly Business Bee

🦜 Traveling Toucan

Strategy: Travel rewards, premium benefits

Cards: Premium Travel Card → Flexible Points Card → Premium Perks Card → Triple Category Card

Best for: Frequent travelers, moderate spenders

Key metrics: $82/month average value, 6.1% value per dollar spent

💳 Capitol One

Strategy: Entry-level excellence, simplicity focus

Target Personas: Primarily No Fee Flamingo, secondary Traveling Toucan

Key Cards: Capital One Savor Student, Capital One Venture X

Market Position: Leader in No Fee segment, highest ROI card (53%)

🐝 Business Bee

Strategy: Business cards with high signup bonuses

Cards: Cash Back Business Card → Flat-Rate Business Card → Flexible Points Business Card → Premium Business Travel Card

Best for: High spenders, business owners

Key metrics: $173/month average value, 10.8% value per dollar spent

🌐 American Express & Citi Bank

Strategy: Niche specialists, complementary roles with unique category strengths

Target Personas: Secondary positions across all three personas

Key Cards: Amex Blue Business Plus, Citi Custom Cash, Citi Premier

Market Position: Strategic additions to rounded portfolios, filling optimization gaps

Credit Card Churn Flowchart (Miro)

Miro Chart Insights

The Miro flow chart above illustrates the strategic card acquisition sequence for each persona, highlighting the progression from entry-level cards to more specialized products. Each sequence is carefully designed to maximize returns while managing application timing.

From the bank perspective, we can see how issuers strategically position themselves:

Chase appears in all three personas, with particularly strong presence in the Business Bee sequence, showcasing their full-spectrum approach to customer acquisition

Capital One dominates the entry-level segment with their high-ROI student card

American Express focuses on specific niches within the Traveling Toucan and Business Bee segments

The flow chart also reveals how banks create product ecosystems - Chase's Ink Business lineup and Freedom cards demonstrate how issuers develop card families that complement each other. This strategic positioning helps banks maintain customer relationships across multiple products while offering consumers opportunities to maximize value through thoughtful card selection.

Dashboard Calculations Breakdown

Cumulative Value Over Time

For each month, we calculate: Monthly Value = Sign-up Bonus - Annual Fee + Monthly Rewards

For each month, we calculate: Monthly Value = Sign-up Bonus - Annual Fee + Monthly Rewards

Sign-up bonuses only apply when a card is acquired

Annual fees apply based on the "Repeat annual fees?" parameter

Monthly rewards vary based on the "Optimized spend?" parameter

The "Continue card sequence?" parameter determines if generic cards are added after the initial sequence

Annual fees apply based on the "Repeat annual fees?" parameter

Monthly rewards vary based on the "Optimized spend?" parameter

The "Continue card sequence?" parameter determines if generic cards are added after the initial sequence

Return on Investment (ROI)

Calculated as: ROI = (Bonus + Rewards - Annual Fee) / Spend Required

Calculated as: ROI = (Bonus + Rewards - Annual Fee) / Spend Required

No Fee Flamingo's Capital One SavorOne Student card leads with 53% ROI

Chase Freedom Flex follows at 45% ROI

Chase Sapphire Preferred offers the best premium card ROI at 21%

Chase Freedom Flex follows at 45% ROI

Chase Sapphire Preferred offers the best premium card ROI at 21%

Monthly Value Rate

Calculated as: Monthly Value Rate = (Bonus + Rewards - Annual Fee) / Spend Timeframe

Calculated as: Monthly Value Rate = (Bonus + Rewards - Annual Fee) / Spend Timeframe

Chase Sapphire Preferred: $318.33/month

Chase Ink Business Preferred: $295.00/month

Chase Ink Business Cash: $270.00/month

Chase Ink Business Preferred: $295.00/month

Chase Ink Business Cash: $270.00/month

Bank Profitability Metrics

Calculated as: Break-Even Time (months) = Bonus / (Spend Required × 20% APR / 12)

Calculated as: Break-Even Time (months) = Bonus / (Spend Required × 20% APR / 12)

Capital One SavorOne Student: 30 months

Chase Sapphire Preferred: 12 months

Chase Ink Business Preferred: 6.8 months

Chase Sapphire Preferred: 12 months

Chase Ink Business Preferred: 6.8 months

Dashboard Parameters

Optimized spend?: Toggle between strategic category optimization and base rewards

Continue card sequence?: Project additional generic cards after initial sequence

Repeat annual fees?: Pay annual fees every year or cancel/downgrade after first year

Years: Adjust time horizon (1-5 years)

Continue card sequence?: Project additional generic cards after initial sequence

Repeat annual fees?: Pay annual fees every year or cancel/downgrade after first year

Years: Adjust time horizon (1-5 years)